Ira Income Limit 2024

Ira Income Limit 2024. The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older. The limits are up from the 2023 tax year, when you could set aside up to.

This is an increase from 2023, when the limits were $6,500 and $7,500, respectively. The irs limits how much you can.

If Less, Your Taxable Compensation For The Year.

The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

For 2024, The Irs Only Allows You To Save A Total Of $7,000 Across All Your Traditional And Roth Iras, Combined.

You can contribute to an ira until the tax deadline for.

The Limit For Annual Contributions To Roth And Traditional Individual Retirement Accounts (Iras) For The.

Images References :

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, $7,000 if you're younger than age 50. The irs limits how much you can.

Source: skloff.com

Source: skloff.com

What Are the IRA Contribution and Limits for 2022 and 2023? 02, This is an increase from 2023, when the limits were $6,500 and $7,500, respectively. Roth ira income and contribution limits for 2024.

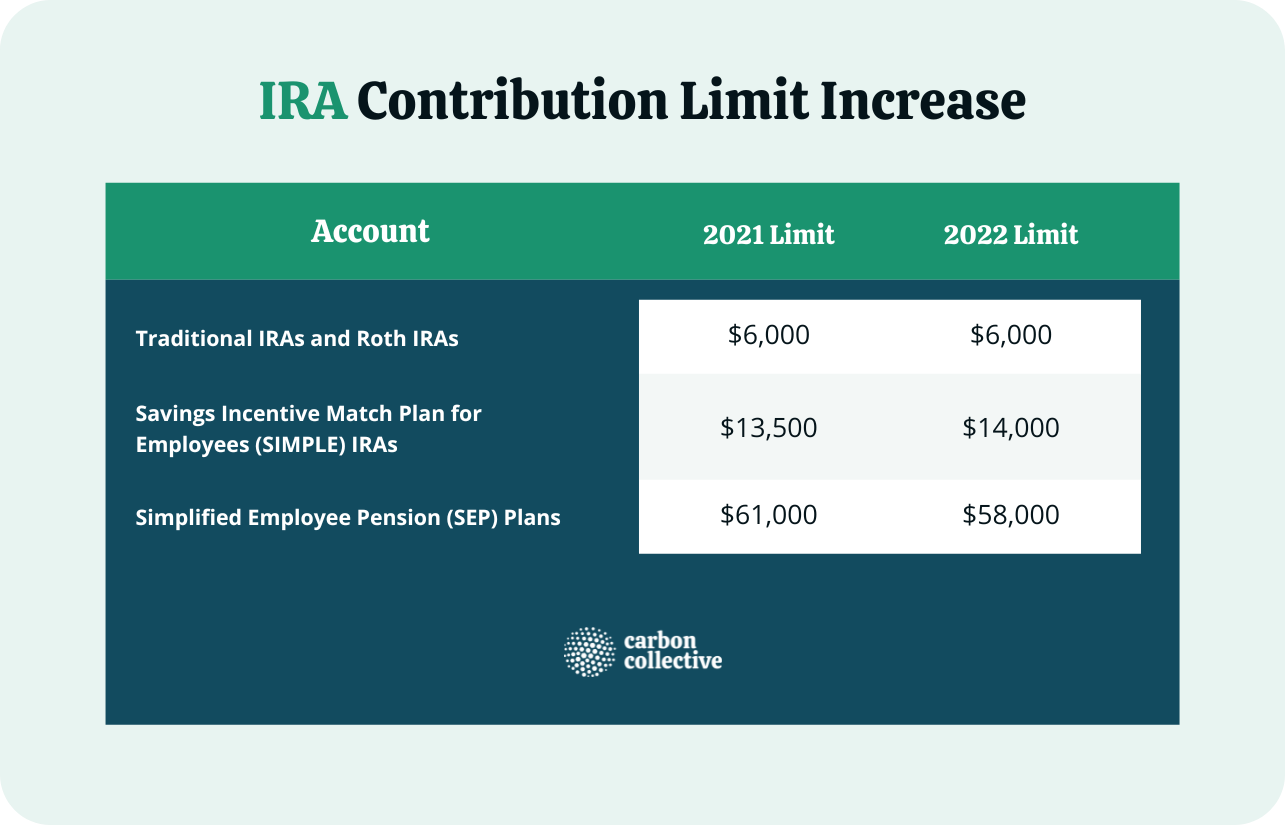

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs 401(k) A Side by Side Comparison, This is a $500 increase to the 2023 limits. In 2024, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

Source: deidreqardelis.pages.dev

Source: deidreqardelis.pages.dev

402k Contribution Limits 2024 Danny Orelle, If your wages surpass the cap , you may want to. Ira contribution limits for 2024.

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. This is a $500 increase to the 2023 limits.

Source: choosegoldira.com

Source: choosegoldira.com

non working spouse ira contribution limits 2022 Choosing Your Gold IRA, You can make 2024 ira contributions until the unextended federal tax deadline (for income earned in 2024). $7,000 in 2024 and $8,000 for those age 50 and older.

Source: choosegoldira.com

Source: choosegoldira.com

simple ira contribution limits 2022 Choosing Your Gold IRA, In 2024, the maximum contribution is $7,000 a year. This figure is up from the 2023 limit of $6,500.

Source: www.financestrategists.com

Source: www.financestrategists.com

Roth IRA Contribution Limits 2022 & Withdrawal Rules, For 2024, the ira contribution limit will be $7,000 or $8,000 if you are at least age 50. The maximum contribution limit for roth and traditional iras for 2024 is:

Source: www.msn.com

Source: www.msn.com

The Insider's Guide to Maximizing Retirement Savings Exploring, This is a $500 increase to the 2023 limits. The irs limits how much you can.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. In 2024, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

For 2024, The Irs Only Allows You To Save A Total Of $7,000 Across All Your Traditional And Roth Iras, Combined.

$6,500 in 2023 and $7,500 for those age 50 and older.

In 2024, The Annual Contribution Limit For Both Roth And Traditional Iras Rises To $7,000 For Those Under 50, And $8,000 For Those 50 And Above.

The contribution limit shown within parentheses is relevant to individuals age 50 and older.